Learn How an Online Business Loan Works | Business Loans

Online Business Loans

Quick Overview

- Shorter term loans from 3-24 months

- Longer term loans from 2-5 years

- Higher approval rates than most banks

- Application can often be completed online

By Bradley Harris | Last Updated: September 10, 2021

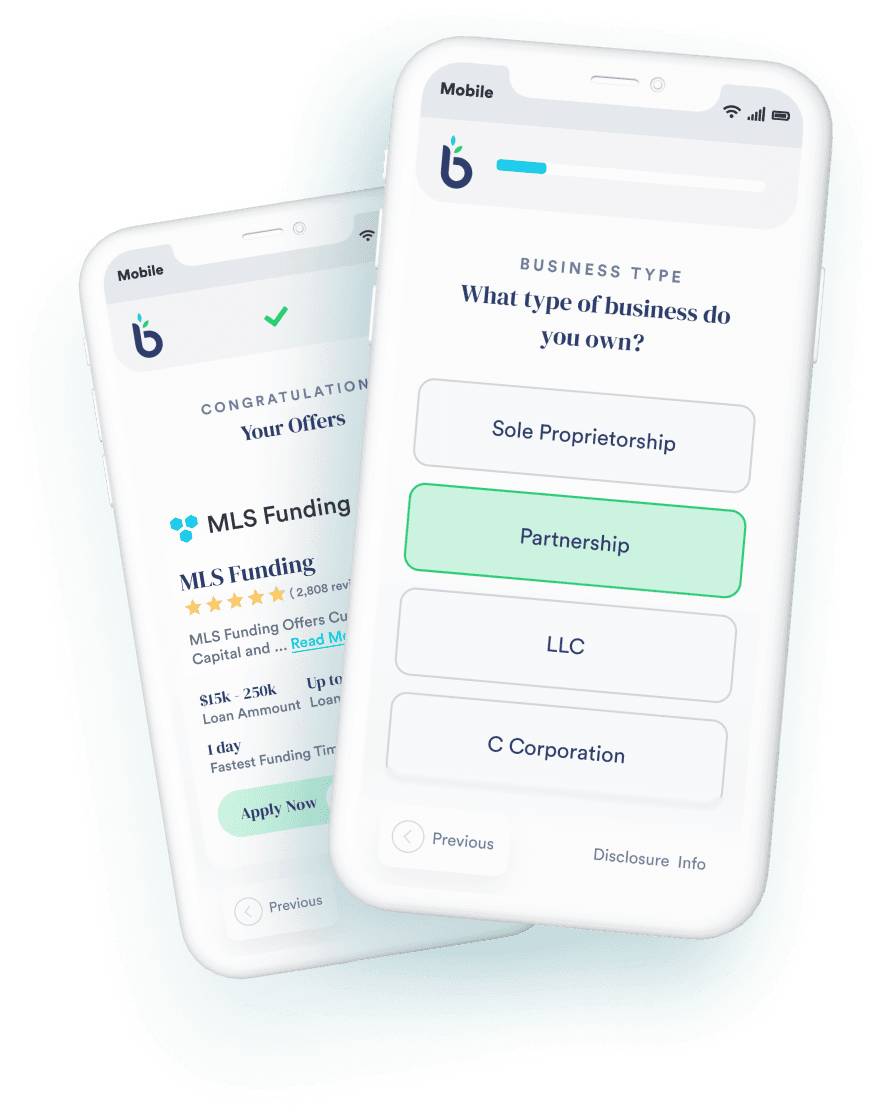

With traditional lenders maintaining a tight leash on credit, more and more business owners turn to a new breed of lenders for their financing needs — a group found entirely online. Fueled by web-based tools that speed up the application process and determine eligibility in a matter of minutes, these lenders typically approve more loans than traditional banks. They can provide financing much quicker than their traditional counterparts.

Many online lenders use technology to evaluate businesses differently from traditional lenders. For example, online lenders may access a business’ transactions and cash flow via their bank account’s website or examine other digital data points to analyze a business.

Shorter Term Online Business Loans

This type of lender provides business owners with loans that range from three to 24 months. These loans are often used for specific, shorter-term projects such as purchasing inventory, launching marketing campaigns, or general working capital. Some examples of shorter-term lenders are:

- OnDeck – works largely with “Main Street” businesses and offers loans of up to $250,000. OnDeck has loaned over $3 billion nationwide. (Disclosure: OnDeck is the sponsor of this site)

- Kabbage – started lending to online businesses and now offers loans up to $100,000

Longer-Term Online Business Loans

These lenders provide business owners with loans that range from 1-5 years with amounts up to $500,000. These loans are often used for longer-term projects such as major renovations or the opening new location. Some examples of these longer-term lenders are:

- Lending Club – the largest personal peer to peer consumer lender now offers business loans up to $300,000

- Funding Circle – started in the U.K. and has lent over $700 million globally to small businesses; Funding Circle offers loans up to $500,000

Application Process

A major benefit of online business loans is how easy it is to apply for a loan. Applications are usually just a single page and tend to be very straightforward. They can be completed online, over the phone, or via fax. However, there are certain things you’ll need for non-bank lenders, including:

- Your Social Security Number

- Your Business Tax ID

- Connection to your business bank account or paper bank statements (for certain lenders)

- Financial statements (typically for larger loan sizes)

Another advantage to working with online lenders is the quickness of their review process. The shorter-term lenders can often provide a decision in minutes or hours, while the longer-term lenders may have a decision within a few days. In a world where an application for financing in a traditional setting can take weeks or even months, the speed and simplicity offered by online business lenders are a major attraction for many business owners.

Rates & Repayment

Online business loans tend to have a higher interest rate relative to traditional bank loans. However, they also have much higher approval rates and can provide funding far quicker than traditional lenders. The rates will vary by lender, term, and risk and are typically lower than other options such as merchant cash advances. Repayment methods also vary depending on the lender, so make sure to do your research and find the best fit for your business. Some lenders require a fixed amount daily or weekly, while others require a traditional monthly payment.

Qualifications and Requirements for Online Business Loans

These both vary from lender to lender, but here are some general guidelines:

- Required Time in Business: Usually between 1-2 years

- Minimum Annual Revenue: $75,000 – $250,000

- Minimum Personal Credit Score: 500-650

- Industry: Industry requirements vary by lender, but restricted industries sometimes include financial services, home builders, real estate investors, etc.

For more updates on online business loans and other small business news, sign up for our newsletter at the top right of this article.

Business Credit

Personal Credit