CDFI Lenders For Small Businesses | Business Loans

CDFI Lenders

Quick Overview

- What is a CDFI?

- What to expect when working with a CDFI?

- When should you contact a CDFI?

By Bradley Harris | Last Updated: June 22, 2022

CDFI Lender Overview, presented by DreamSpring

For small business owners, accessing capital from traditional banks can be uncertain and tricky, even in the best economic conditions. For new entrepreneurs or small business owners in underfunded or marginalized communities — including people of color, women, people with disabilities, and veterans — finding the right resources can be even harder. Fortunately, there’s a robust network of financial institutions whose mission is to serve entrepreneurs who face systemic barriers to accessing credit and capital: CDFIs.

What Is a CDFI?

CDFIs, or Community Development Financial Institutions, are organizations that share a commitment to providing capital to individuals underserved by the financial mainstream. To broaden economic opportunities, CDFIs can be structured as credit unions, venture capital funds, banks, and loan funds. Because CDFIs are specialized lenders, they offer loan products and services to help build wealth and support local communities. Many CDFIs are non-profit lenders with a mission focus, allowing them to provide unique and flexible financial products and services. More than 1,300 CDFIs operate nationally, and many are small business lenders supporting entrepreneurs who cannot obtain financing from a traditional bank.

CDFIs as Trusted Partners

With a mandate to empower entrepreneurs and communities, CDFIs are a trusted partner for those seeking capital to start or grow small businesses. While CDFIs are certified by the U.S. Department of Treasury, they are not regulated like mainstream banks, which allows for greater flexibility in loan products and underwriting criteria. Working with startups and existing small businesses, CDFIs can tackle financing needs large and small to meet needs from a few hundred dollars to several million — creating jobs and bringing critical goods and services into communities along the way. "CDFIs recognize that entrepreneurship, supported by equitable access to capital, creates a path to economic mobility that benefits us all,” said Anne Haines, President and CEO of DreamSpring.

What to Expect When Working with a CDFI

Most CDFI lenders provide favorable terms to small business owners, especially if capital is unavailable from traditional sources. To ensure small business success, CDFIs may also offer access to business assistance, educational programming, and resources to help entrepreneurs expand their skillsets and professional networks. Small businesses, startups, microenterprises, and nonprofits are welcome to apply for funding. For most CDFI small business lenders, funds may be used for working capital, equipment purchases, commercial real estate purchases, leasehold improvements, business acquisition, and more. The funding process will vary by organization, but applicants should expect to share details about how they intend to use borrowed funds, financial documentation, owner identity information, and personal financial information. Some loan products, like those offered in partnership with the U.S. Small Business Administration (SBA), may require additional documentation and processing time. The likelihood of approval increases when working with a CDFI, and loan products are typically more straightforward, with clear terms and structure. Because CDFIs want to help individuals build credit, many organizations allow for repeat customers and larger subsequent loan amounts for borrowers with good repayment histories. Many CDFIs have relationship-driven teams to support applicants along the way, helping small business owners navigate the process.

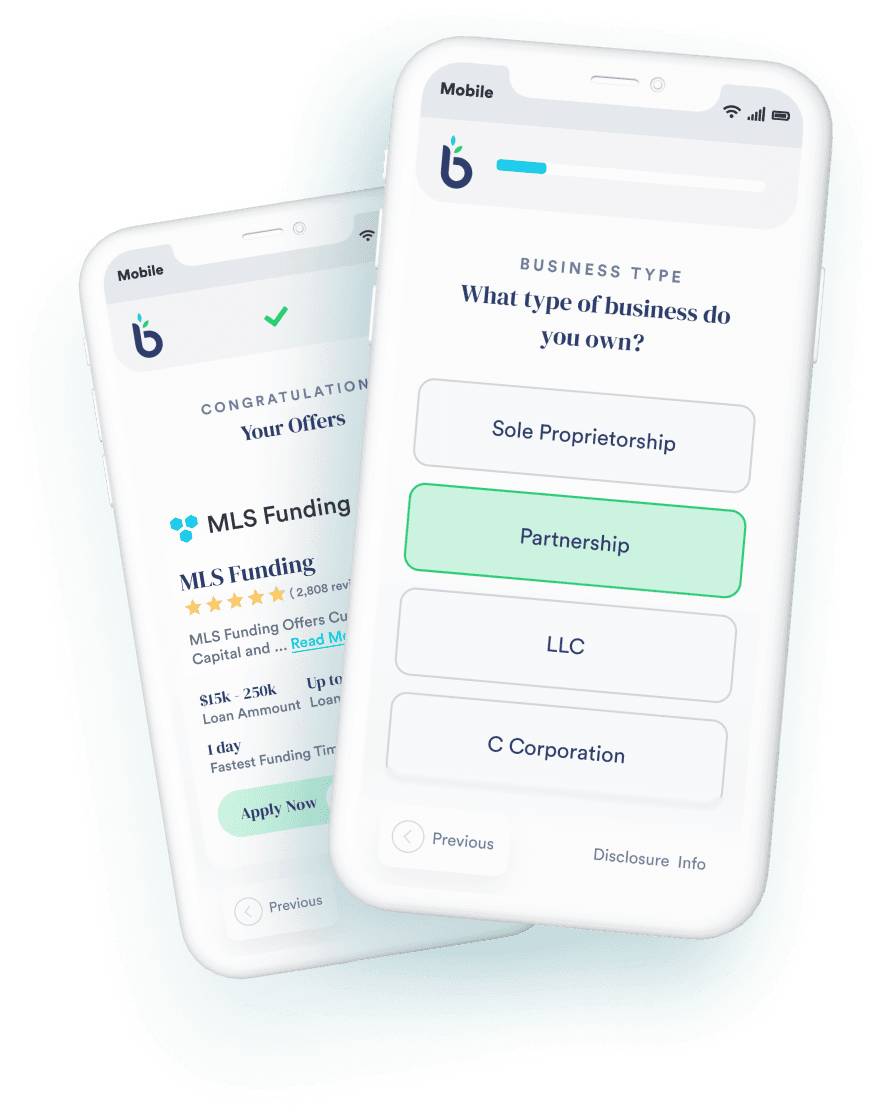

CDFIs can offer both fast access to money with online services and tailored support from trained loan specialists who can navigate challenges that the borrower may be facing.

When Should You Contact a CDFI?

Applying for capital before you have an urgent need will give your small business breathing room. If you are operating in an underserved community, a CDFI may be the best fit for your business needs. As a startup entrepreneur, accessing capital from a CDFI can help your venture scale. A CDFI can also be a great partner to existing small businesses that have a financing need but are unable to work with a traditional bank. CDFI lenders want to help you access the funds you need and work with you to successfully repay your loan. But even more importantly, CDFIs aspire to be a partner to your small business, empowering you and your community flourish.

Do you think working with a CDFI is a fit for your small business?

Learn more about what to expect by visiting DreamSpring’s loan readiness page.

Equity Financing

Online Business Loans